KUALA LUMPUR (Aug 10): PLS Plantations Bhd plans to venture into the downstream durian production and distribution businesses to provide additional revenue source and enhance the profitability of the group, through the acquisition of a 70% stake in Dulai Fruits Enterprise Sdn Bhd.

In a filing with Bursa Malaysia today, PLS said it has entered into a binding term

sheet with Eric Chan Yee Hong to exclusively explore and negotiate further with him

over the subscription of a 30% stake in the enlarged share capital of Dulai, by a

wholly-owned subsidiary to be incorporated by PLS (SPV), for RM3 million cash.

The term sheet also entails the acquisition by the SPV of Dulai shares from Chan, representing 40% of the enlarged share capital of Dulai post the proposed shares subscription, for RM18 million to be satisfied via issuance of 24 million new shares in PLS at an issue price of 75 sen per PLS share.

The issue price of 75 sen per PLS share represents a discount of 12.94% and 7.37% to the 5-day and 30-day volume weighted average market price of PLS shares up to and including Aug 8, 2018 of 86.15 sen and 80.97 sen respectively.

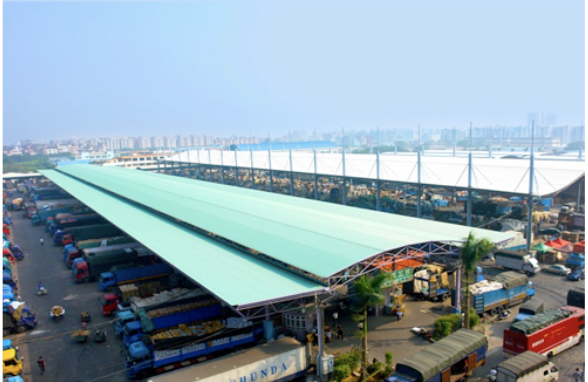

Dulai is in the business of export and import of fresh or preserved vegetables and fruits.

Under the proposed transaction, Dulai will provide a profit guarantee of not less than RM10 million in net profit for the financial years ending 2019, 2020 and 2021.

PLS intends to fund the proposed shares subscription via internal funds and/or bank

borrowings.

"A detailed announcement on the proposed transaction will be made upon

finalisation of the terms and conditions of the relevant definitive agreements," PLS said.

Astramina Advisory Sdn Bhd is the appointed financial advisor for PLS, in relation to

the proposed transaction.

PLS shares closed five sen or 5.53% higher at 95 sen today, with 5,000 shares traded, for a market capitalisation of RM313.63 million.

.svg)

.svg)

.svg)