KUALA LUMPUR: PLS Plantations Bhd is expecting the durian business to contribute to half of its earnings within the next three to four years from the 26% in the most recent quarter.

“In the next six to seven years, the durian segment is expected to be the main revenue driver for the group,” PLS’ subsidiary Dulai Fruits CEO Eric Chan told the media after its EGM yesterday.

Towards this shift, he said PLS has allocated a capital expenditure of RM80 million for downstream and RM90 million for upstream business.

Overall, the group has a total landbank of 80,000 acres with 1,200 acres of durian farms. In the next two years, it plans to acquire 200 acres of durian farms to expand its upstream capabilities.

PLS plans to export its durians to more countries such as Australia, the US and Middle East in the coming years after making its foray into Japan last year.

“So far, we have received a decent response in Australia, despite being a smaller market, but population wise, the sales potential is there and the same with the US.”

“We are looking to achieve a production of 100 tonnes of durians per day by the middle of 2020,” said Chan.

In order to expand production capacity, PLS executive director Lee Hun Kheng said the group has identified two potential areas to complement its existing two factories in Shah Alam, Selangor and Masai, Johor.

PLS exports 90% of its durians to China. While there have been delays in order shipments to China, Chan said the company has not seen any order cancellations as a result of the novel coronavirus outbreak.

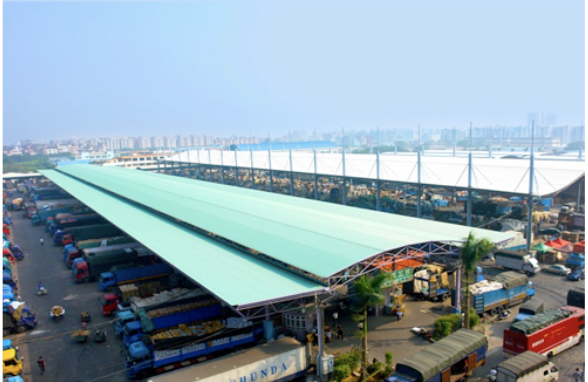

“Our shipments have been affected by port closures in February due to the bottleneck instead of concerns from the outbreak.”

““The authorities have told us that port closures were due to increased shipment volume, and the ports are scheduled to resume in early March,“ he added.

Prior to port closures, PLS exported an average 10 containers of durians to China per month.

Earlier, PLS received shareholders’ nod for its proposed issue of 175.35 million new warrants on the basis on one warrant for every two shares held as well as the proposed rights issue of up to 1.05 billion new redeemable preference shares (RPS) on the basis of two RPS for every one share held.

The proposed rights issue is expected to raise up to RM1.05 billion, mainly for expansion and investment in its durian plantation business.

.svg)

.svg)

.svg)