DURING the durian season, diehard fans of the king of fruits with its pungent smell and creamy texture would surely make a beeline for it. Its lucrative margins have led to many investors seeking exposure to this market through listed durian planter PLS Plantations Bhd.

Compared with the oil palm business, margins from the durian business are much higher. “Assuming we use the same kind of plantation costs, the net margins for durians can easily go up to 50% and above. Net margins for oil palm hover around 20% most of the time,” a plantation analyst tells The Edge.

Regionally, demand for durians has been picking up. Data from the Department of Statistics Malaysia shows that exports of durian (which include fresh, frozen, pulp and paste) grew 34.6% to RM570.8 million last year from RM424.1 million in 2019, with China, Singapore and Hong Kong being the main export destinations, accounting for 70.3%, 8.3% and 6.1% respectively.

Recognising the huge potential market for durians, in 2019, the then loss-making PLS, which is controlled by tycoon Tan Sri Lim Kang Hoo, took a leap of faith in the durian plantation business and has never looked back.

For the 12-month period ended March 31, 2021, PLS returned to the black, reporting a net profit of RM9.84 million compared with a net loss of RM6.33 million a year ago. It changed its financial year-end to June 30 from March 31 to coincide with the financial year of its holding company, Ekovest Bhd, which holds a 73.08% stake in PLS.

The latest quarterly earnings of PLS came in at RM2.42 million from a net loss of RM5.6 million. Besides the increase in the sale of fresh fruit bunches as a result of higher average selling prices, the improved results were also contributed by higher sales of frozen durian products.

PLS did not provide a profit breakdown of its oil palm and durian plantation businesses. Certainly, its ability to make sustainable earnings from the new venture will be in focus.

“PLS’s durian production and earnings are not sizeable yet. If they can make the durian venture profitable, then it will be the first listed plantation company to be able to do so in Malaysia,” says the analyst.

The long gestation period could pose a challenge for PLS, however, as it typically takes six to seven years for a durian plantation to start yielding results.

“Besides that, the durian harvesting period is seasonal, while palm oil is defensive and steady throughout the year, as the commodity is needed at all times,” says the analyst.

He stresses that, to perform well in durian plantation, PLS must build up its value chain to establish a one-stop service centre. For instance, speedy delivery of durians to overseas markets will ensure the quality is not compromised. Also, Thai durians can be kept longer than Malaysian durians, as Thai growers usually pluck unripe durians for sale.

“Our durians are not long-lasting and need to be consumed within days after they are harvested. Taste-wise, of course Malaysian durians are more appealing,” the analyst says.

He believes there should be a proper plan for downstream development to cater for the local market and the processing of durians into its by-products.

Still, he adds, the fact that Thai durian exports are 10 times larger than Malaysia’s may suggest that the country needs to ramp up its marketing efforts.

When contacted by The Edge, PLS declined to comment except to say that it was in the midst of updating its business model and direction.

PLS has a total plantation area of 11,000ha and 730ha for oil palm and durian respectively. It said in its 2020 annual report that, faced with a gestation period for the cultivation of durian trees before the segment can provide sustainable returns, it would undertake other aquaculture and cash crop products on the plantation land to fully utilise it and its surrounding areas.

The subscription of PLS’s 19 million placement shares by former banker Datuk Seri Nazir Razak for RM18.05 million, or 95 sen a share, made headlines early this year. This move was to improve the planter’s public shareholding spread and raise money to finance the expansion of its existing business.

Yet, PLS’s public shareholding spread was still low at 10.16% as at July 30, a shortfall of 14.84% from the 25% requirement. This prompted the company to submit an application to Bursa Malaysia last Monday for a further extension of six months to comply with the requirement.

Since Nazir’s entry, however, PLS’s shares have seen little change. The stock has declined about 4.7% year to date to close at 91.5 sen last Friday, giving the company a market capitalisation of RM365.69 million.

Lim, who is executive vice-chairman of PLS, has seen his shareholding in the plantation firm increase to 73.08% as a result of Ekovest’s takeover offer for PLS. Nazir, who was appointed PLS’s non-executive independent chairman last February, holds a 4.75% stake in the company.

In 2019, China allowed the import of the whole fruit, leading to a surge in durian prices in the domestic market. PLS has said its durian business returns can “easily overtake” its oil palm plantation earnings as the company embarks on its upstream durian cultivation expansion. The goal is for the durian business to become the main revenue driver in the next five to six years. The durian segment contributed 26% to total earnings in 2020.

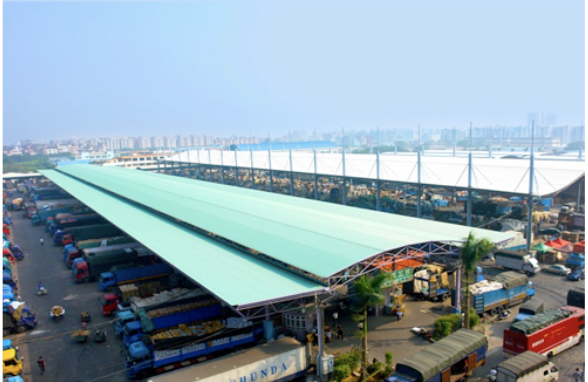

Last December, the company acquired 14.81 acres of land in Raub, Pahang, for RM11.5 million to expand its durian cultivation business. The intention is to set up a durian business hub comprising a collection centre, processing facilities, distribution centre and retail centre for fresh durians.

Regional durian player Singapore-listed NutryFarm International Ltd has also gained traction from its durian distribution and exporting business. The Hong Kong-based NutryFarm raked in earnings of HK$457,000 (RM248,622) for 2QFY2021 compared with losses of HK$5 million a year ago, after registering full-year losses since FY2018.

It sees technical knowledge as being key when dealing with fresh produce, and it goes far beyond just buying durians and sending them to China. The company has also secured a sole distributorship of Malaysia’s Musang King frozen durian pulp in Singapore for a period of two years.

In the case of PLS, although the durian business can provide good margins, its returns may not be as stable as those of the oil palm plantation. To be fair, investors need more time to assess the contribution from the durian venture.

.svg)

.svg)

.svg)